Historical Crediting Interest Rates of Universal Life Products

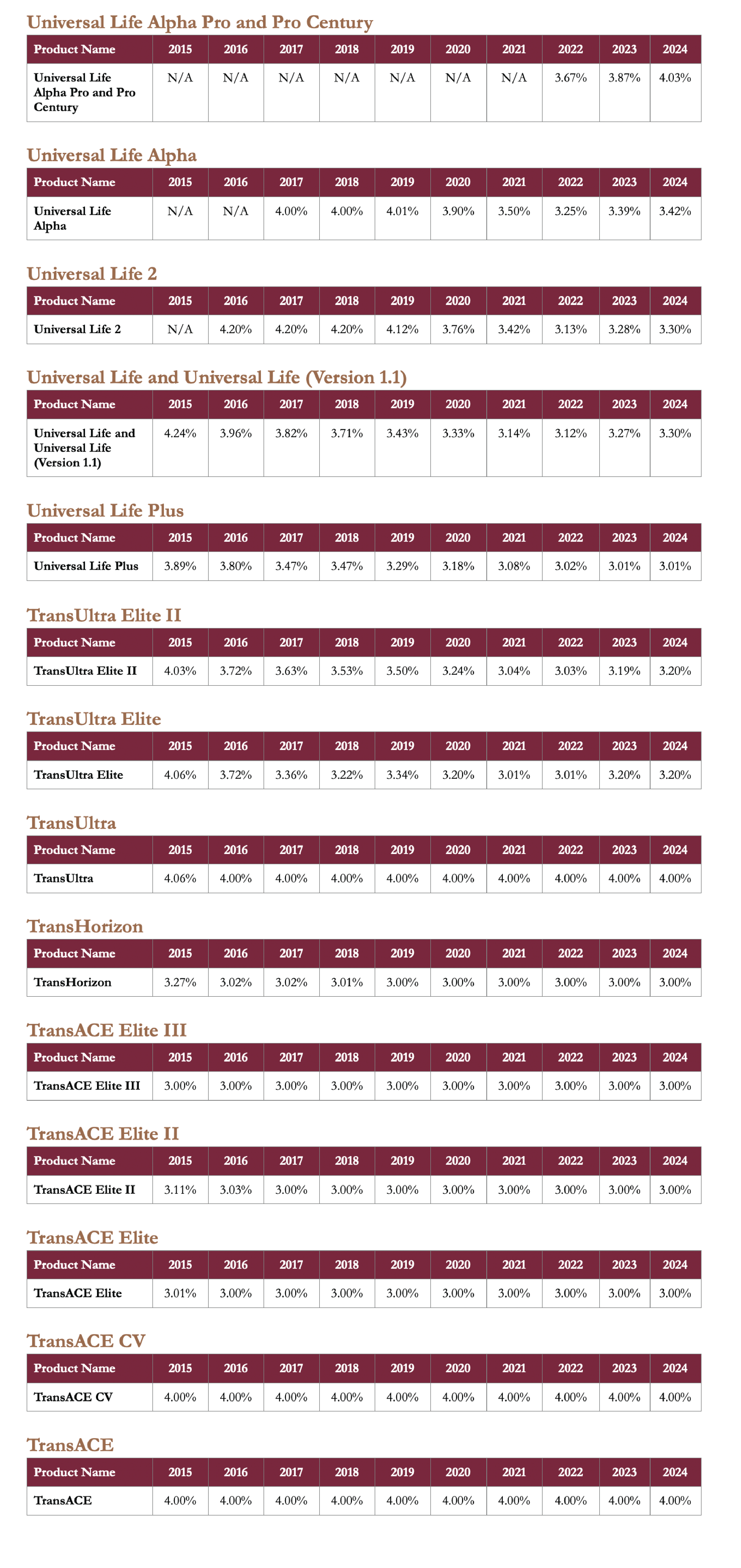

Below are the historical Crediting Interest Rates of our current universal life products and the discontinued universal life products for which we issued new policies since 2010 with inforce policies in the reporting year 2024. The rates shown are the weighted average of the crediting interest rates of each product in a given year with reference to the guidelines provided by the Insurance Authority of Hong Kong.

Products that are not listed below are either launched less than one year ago (therefore no historical crediting interest rate is available at this time) or products that do not have inforce policies in the reporting year 2024.

The historical Crediting Interest Rates shown below are for reference only. They should not be taken as an indicator of future crediting interest rates which may be higher or lower than in the past.

Please note that the Crediting Interest Rate on any policy depends on factors such as the date that the policy is issued, the sum assured and the date of each premium payment. Therefore, if you are a policy owner, please refer to your annual statement for the actual crediting interest rates applicable to your policy.

Crediting Interest Rates for Reporting Year 2024

Notes:

1. The Crediting Interest Rates shown are before any relevant policy charges (e.g. cost of insurance, monthly expense charge, etc.).

2. The Crediting Interest Rates shown have not taken into account any bonus Crediting Interest Rates.

3. “N/A” denotes product was not available in the relevant year.

Crediting Interest Rate Philosophy for Universal Life Plans

The crediting interest rates for our policies are primarily based upon the performance of the underlying investments of Transamerica Life Bermuda, after allowing for the costs incurred by, and profits attributable to, the company. Performance of the underlying investments, and therefore the crediting interest rates, may be affected by changes in the financial markets and economic conditions which include changes in interest rates, corporate bond spreads and asset default rates.

A number of factors are considered when determining the crediting interest rates for your universal life insurance policy. These factors include, but are not limited to, future investment expectations, the cost of providing the guaranteed minimum crediting interest rate applicable to your policy, and the long-term affordability of the crediting interest rates.

Transamerica Life Bermuda recognises that market conditions can be unpredictable and investment performance can be volatile in the short term. Through our investment philosophy and approach, we aim to deliver a fair return determined from the underlying investments and ensure a stable crediting interest rate by spreading out and managing gains and losses over a longer period of time.

In addition, crediting interest rates of your policy may be affected by claims and persistency experience (including withdrawals, surrenders and policy lapses).

The crediting interest rates are also subject to the guaranteed minimum crediting interest rates* and lock-in crediting interest rates as stated in your policy contract, where applicable.

We will review the crediting interest rates of our policies annually or more frequently as needed.

The crediting interest rate policy and resulting crediting interest rates are formulated based on actuarial principles and professional judgment to balance the interests of policyholders and shareholders over the long run. The recommendations made on policy and rates are approved by our Board of Directors. At least one-third of our Board is comprised of Independent Non-Executive Directors.

* Guaranteed product features are dependent upon the claims-paying ability of the issuer.

Investment strategy

Recognising our customers' needs for sound financial security, TLB combines performance-driven investment strategies with prudent risk management frameworks to help our High Net Worth customers achieve financial security and provide them with peace-of-mind. We aim to maintain stable returns for customers throughout their policy terms by securing high-quality assets that provide attractive risk-adjusted returns.

TLB invests primarily in investment-grade fixed-income assets which are well diversified across classes, sectors, and industries. As of 31 December 2023, 93.9% of our bonds carried investment grade ratings from external rating agencies such as Standard & Poor’s and Moody’s, and 4.8% carried the highest possible credit rating of AAA.

Security selection and credit risk analysis are managed by asset class-specific experts within Aegon Asset Management. Robust risk management frameworks ensure that all investment-related risks – including credit risk – remain within limits set by TLB’s management and approved by our Board of Directors.

TLB’s investment portfolios are 100% US dollar-denominated to match the currency of our product offerings.

Our investment strategy may change over time in response to things like changing financial markets or economic conditions, new product offerings, or regulatory guidelines. Material updates to TLB’s crediting interest rate philosophy or investment strategy will be published on our website at www.transamericalifebermuda.com.

Life insurance policies are issued by TLB, a company incorporated in Hamilton, Bermuda.

Updated Insurance Terminology

We have changed certain insurance terminology in our product materials with reference to the guidelines provided by the Insurance Authority of Hong Kong, including Product Summary, illustrations and the related correspondence. Please refer to the mapping table below.

| OLD TERMINOLOGY | UPDATED TERMINOLOGY |

| Accumulation Value | Account Value |

| Administrative Charges | Premium Charge |

| Crediting Rate | Crediting Interest Rate |

| Current Interest Rate | Current Crediting Interest Rate |

| Face Amount | Sum Assured |

| Guaranteed Minimum Interest Rate | Guaranteed Minimum Crediting Interest Rate |

| Interest Rate | Crediting Interest Rate |

| Lock-in Interest Rate | Lock-in Crediting Interest Rate |

| Lock-in Interest Rate Period | Lock-in Crediting Interest Rate Period |

| Planned Periodic Premium Period | Planned Premium Payment Term |

| Surrender Penalty | Surrender Charge |

| Surrender Penalty Factor | Surrender Charge Rate |

| Surrender Penalty Period | Surrender Charge Period |

| Policy Value | Cash Value / Account Value (depends on the context) |